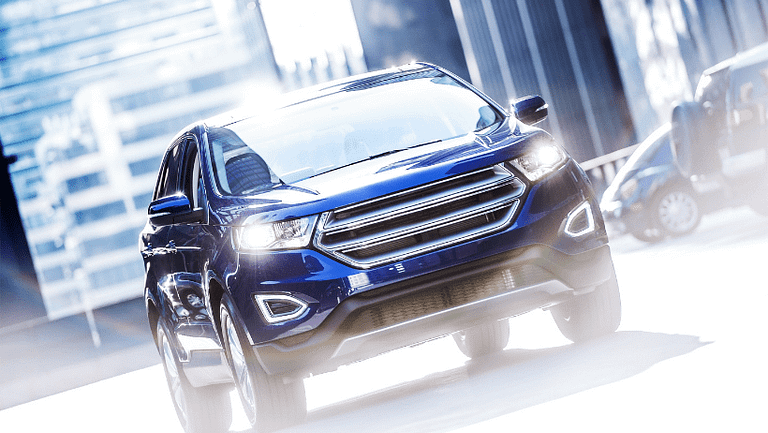

Commercial Auto Insurance

Posted: August 16, 2022

Commercial auto insurance can cover various vehicle types (trucks, cars), drivers, and motorized equipment. It covers bodily injury liability and property damage when driving a work car, as well as medical payments or Personal Injury Protection (PIP) for the policyholder's driver and passengers. Auto Liability (hired/non-owned) Do your staff drive their own automobiles, or do you rent them? This coverage protects your business against...

Does Your Auto Insurance Cover Air Conditioning?

Posted: August 16, 2022

Driving a car with no A/C can be miserable during the hot summer months, particularly during a heatwave. As important as it is to your comfort and that of your passengers, automotive air conditioning can be expensive to repair or replace when it breaks down or malfunctions. In many cases, when the A/C malfunctions it is considered normal wear-and-tear and not covered by auto insurance...

We Think Of Insurance as a Promise

Posted: July 21, 2022

Business and personal insurance update Many people look at insurance as a commodity, like buying car or a piece of furniture. Consequently, they become caught up in searching for the lowest price for the “product of insurance.” Insurance is less of a commodity and more of a promise or service. Promise vs. product Insurance is a promise from the insurer to cover your claim or...

When To Call Your Agent?

Posted: July 16, 2022

If you are shopping for personal insurance, including homeowner’s insurance, auto insurance, RV, boat, or motorcycle insurance, the process can be much easier than you think. Working with an independent agent will save you both time, and money on your personal insurance. But once you have insurance, don’t stop calling us. There are a number of reasons to stay connected with us. The more we...

How Much Auto Liability Insurance Is Enough?

Posted: July 11, 2022

Auto Liability Insurance Update We often get asked the question, “How much auto liability insurance do I need?” The answer to that question is different for everyone. We do recommend that everyone carry at least $500.000 auto and personal liability limits. Auto liability coverage provides protection in the event you injure a third party while driving. Serious injury or death from a car accident is...