Insurance Is A Promise To Perform

Posted: December 15, 2023

Insurance is often described as a promise to perform. At its core, insurance is a contract between an individual or entity (the policyholder) and an insurance company. This contract is based on trust and the expectation that, in the event of a covered loss or occurrence, the insurance company will fulfill its promise to provide financial protection. In this blog, we will explore why insurance...

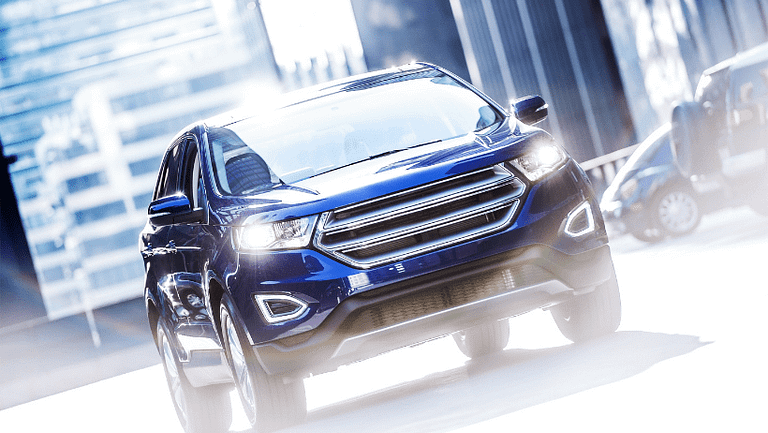

Risk Factors That Affect Your Auto Insurance Premium

Posted: November 22, 2023

When it comes to purchasing auto insurance, various factors come into play to determine your premium rates. Insurance providers assess your risk level based on a multitude of factors, aiming to gauge the likelihood of you filing a claim. Understanding these risk factors can empower you to make informed decisions and potentially lower your auto insurance costs. In this blog, we'll explore the key risk...

How often should I update my insurance policies?

Posted: November 2, 2023

As your life changes, your insurance policies should, too. Whether you’re celebrating a new chapter in your life or navigating significant changes, staying on top of your insurance needs is crucial to ensure you’re adequately protected. Major life events can dictate how often and when you should update your insurance policies, especially after significant life events like marriage, job changes, relocations, or expanding your family....

5 Tips to Keep Teens Safe Behind the Wheel

Posted: October 16, 2023

This week is National Teen Driver Safety Week (October 15 through 21, 2023). Due to various factors, teen drivers have a higher risk of being involved in a crash than older drivers. Parents play an important role in teen driving safety. The following are tips to help keep teenagers safe behind the wheel. Schedule Driving Practice Sessions With Your Teenager One of the main risk...

How Agents Can Help You Get Competitive Car Insurance

Posted: September 22, 2023

Insurance agents can play a significant role in helping you obtain car insurance quotes by providing personalized assistance and guidance throughout the process. Here's how agents can assist you in getting car insurance quotes: Competitive Car Insurance Expertise and Knowledge: Insurance agents are well-versed in the intricacies of different insurance policies, coverage options, and pricing structures. They can explain complex insurance terms, answer your...